December 29, 2023

The saying we like the most is “Marry the home/commercial property, date the rate”. You can always refinance later when the rates drop back to their most attractive points, but you don’t want to miss the opportunity of the perfect property slipping away because it is higher than what you’d like for it to be.

NAR forecasts mortgage rates to average 6.3% in 2024. As rates come down, “the momentum is moving in the right direction for stronger sales activity in 2024,”

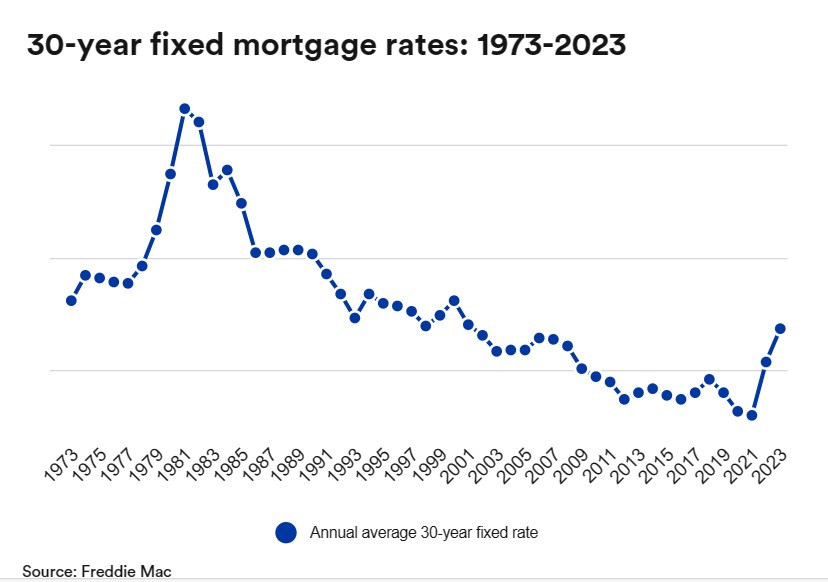

For some, today’s rates seem intimidating, but let’s take a look back to our past for the sake of comparison. Did you know that in 1971 the 30-year fixed-rate mortgage rate was 7.3%? That feels familiar. By 1981, the 30-year fixed mortgage rate reached a whopping 18.4%, according to Freddie Mac. Once the inflation on pricing was reined in, the 30-year rate seesawed down to the 9% range, closing the decade at 9.78%. (source: Mortgage Rate History: 1970s to 2023 | Bankrate)

The moral of this article is this- yes, the rates are a touch higher than they have been over the past handful of years, but honestly, they are still great rates! People are still moving. Housing/business needs change for many every single day. Rates fluctuate. If you are ready or needing to move, we hope that you focus on your need and worry less about the rate. As we stated earlier in this blog, you can always refinance when the rate becomes what you are looking for. Our trusted lenders have creative ways to take care of your needs.